This calculator might also estimate how early a person who has some more money at the conclusion of monthly can repay their loan. Simply increase the additional into your "Month-to-month Pay" portion on the calculator.

The arrangement may perhaps offer with the property finance loan broker to present equally the creditor's covered transaction and another lined transaction offered by A further creditor that has a decreased interest level or maybe a decreased total greenback volume of origination low cost points and factors or service fees. See comment 36(e)(three)-3 for advice in deciding which action-charge home loan includes a reduce curiosity price.

Charge card premiums is usually set or variable. Charge card issuers aren't necessary to give advanced recognize of the desire fee enhance for charge cards with variable interest premiums. It is feasible for borrowers with fantastic credit score to ask for much more favorable costs on their own variable loans or charge cards.

Greatest IRA accountsBest on the internet brokers for tradingBest on the web brokers for beginnersBest robo-advisorsBest options trading brokers and platformsBest buying and selling platforms for day buying and selling

Lenders often subtract an origination price right before sending you funds, efficiently lowering your loan quantity. Your calculator benefits will fluctuate determined by how the rate is used.

Any supplemental draw against the line of credit history that the creditor from the included transaction does not know or have purpose to find out about right before or throughout underwriting needn't be considered in relation to ability to repay. One example is, where the creditor's procedures and procedures require the supply of down payment to become confirmed, along with the creditor verifies that a simultaneous loan that is a HELOC will deliver the source of deposit for the main-lien included transaction, the creditor will have to consider the periodic payment to the HELOC by assuming the amount drawn is at the least the deposit amount. Normally, a creditor must ascertain the periodic payment dependant on steering during the commentary to § 1026.forty(d)(5) (talking about payment phrases).

two. Increased of the fully indexed amount or introductory level; high quality adjustable-amount transactions. A creditor must decide a purchaser's repayment potential with the covered transaction working with substantially equivalent, monthly, thoroughly amortizing payments which are depending on the bigger of your fully indexed charge or any introductory fascination price.

v. Depending on these assumptions, the every month payment for that non-common mortgage for purposes of deciding whether or not the regular mortgage loan regular payment is decreased compared to non-regular mortgage every month payment (

(i) The patron's existing or reasonably predicted profits or belongings, aside from the value of your dwelling, which include any authentic residence attached to the dwelling, that secures the loan;

(ii) The creditor decides at or prior to consummation that The customer might make the entire scheduled payments under the phrases from the lawful obligation, as explained in paragraph (f)(1)(iv) of the section, together with the consumer’s month to month payments for all house loan-similar obligations and excluding the balloon payment, from the consumer’s recent or reasonably anticipated 43 cash loan revenue or assets other than the dwelling that secures the loan;

For uses of this paragraph (e)(two)(vi), the creditor should determine the once-a-year percentage amount for any loan for which the interest charge might or will transform in the very first 5 years once the day on which the 1st standard periodic payment will probably be because of by managing the maximum interest level that may utilize in the course of that five-year time period as being the fascination fee for the total time period in the loan.

, the fully indexed price), the creditor will have to not give any influence to that price cap when figuring out the fully indexed level. That's, a creditor have to establish the absolutely indexed price with out taking into consideration any periodic curiosity rate adjustment cap that may limit how speedily the thoroughly indexed level may be achieved at any time over the loan time period beneath the phrases on the legal obligation. For instance, believe an adjustable-fee mortgage loan has an Preliminary fixed charge of five p.c for the initial three a long time from the loan, and then the rate will modify per year to the specified index additionally a margin of 3 %.

For instance, a loan phrase of 10 years with periodic payments based on an amortization duration of 20 years would end in a balloon payment staying because of at the end of the loan term. Whatever the loan term, the amortization period of time used to ascertain the scheduled periodic payments that The customer will have to pay out beneath the phrases from the authorized obligation may not exceed thirty several years.

Car or truck purchasers should experiment with the variables to determine which phrase is most effective accommodated by their finances and problem. For extra details about or to complete calculations involving mortgages or automobile loans, remember to check out the Home loan Calculator or Automobile Loan Calculator.

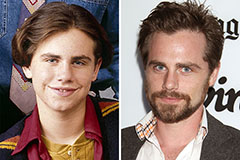

Rider Strong Then & Now!

Rider Strong Then & Now! Romeo Miller Then & Now!

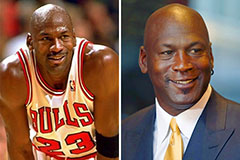

Romeo Miller Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Kane Then & Now!

Kane Then & Now! Jeri Ryan Then & Now!

Jeri Ryan Then & Now!